The big news of "slimming medicine", the world’s first pharmaceutical company with market value has reached a new high! There is a huge room for improving the industrial penetration rate, and these A-

In 2024, diet pills are still hot.

Lilly Mufengda was approved for listing in China

On May 21st, National Medical Products Administration official website showed that Lilly Mufengda (Telpotide Injection) was approved by the National Medical Products Administration (NMPA) to improve blood sugar control in adults with type 2 diabetes.

Telpotide is a GIPR and GLP-1R agonist injected once a week. GLP-1 and GIP are two natural incretins. Studies show that GIP can reduce food intake and increase energy consumption, thus reducing body weight. When GIP is combined with GLP-1 receptor agonist, it may have a greater impact on patients’ blood sugar and weight.

It is worth mentioning that telpotide can produce better weight-losing effect than Smegrupeptide, which is known as the "slimming medicine". Relevant research data show that the weight of the subjects with 5mg and 10mg of Mufengda decreased by 7.8kg and 10.3kg on average, and that of the group with 1mg of Smegliptide decreased by 6.2kg on average.

Regarding the approval of this drug, Lilly said that the approval of telpotide injection represents a breakthrough in the field of diabetes research and development.

On May 21st, local time, Lilly, which listed on the US stock market, rose by 2.55%, and its latest closing price reached US$ 803.17 per share, a record high. At present, its total market value reached US$ 763.337 billion, making it the highest pharmaceutical company in the world.

There is a big room for growth in the diet pills market.

At present, due to the high price of GLP-1 and the low level of patients’ cognition, the penetration rate of GLP-1RA drugs in China is low. This also means that there is a large space for drug penetration in the future. According to the data released by Zhuozhi Consulting, in developed countries in Europe and America, the GLP-1 market has accounted for about 20% of hypoglycemic agents, while in China, the GLP-1 market started late and patients have high price sensitivity, so there is still much room for growth.

According to the GLP-1 Industry Blue Book, the global GLP-1 market will be about US$ 19.85 billion in 2022, and it is expected to grow rapidly to US$ 55.2 billion in 2030, accounting for 57% of the global diabetes drug market. China Merchants Securities Research Report mentioned that GLP-1 drugs have a broad market prospect in the field of metabolism. It is estimated that by 2030, the market scale for type 2 diabetes and obesity will exceed 100 billion US dollars.

According to the Insight database, Novo Nordisk’s GLP-1 receptor agonist Smegrupeptide tablets and injections have been approved for the treatment of diabetes in China. At present, 112 new GLP-1 drugs have entered the clinical stage in China.

Recently, a number of concept stocks of diet pills in the A-share market revealed the layout progress.

Borui Medicine said that as of April 27th, 2024, all subjects in BGM0504 injection for treatment of type 2 diabetes and indications for weight loss had been enrolled in the Phase II clinic, among which all subjects in the 5mg dosage group for diabetes indications had been excluded, and one case in the 10mg dosage group had not been excluded.

The GLP-1 product liraglutide injection phase III of Shuanglu Pharmaceutical Co., Ltd. is currently in the process of clinical trial data collation, and CSR is expected to be completed in September. GLP-1-Fc fusion protein (dulaglutide) is currently in the process of phase III clinical trial data collation, and at least one of the above two varieties will be declared in the second half of the year.

Hanyu Pharmaceutical revealed that as of May 2, the total amount of contracted orders for liraglutide preparations and various GLP-1 APIs of the company was nearly 600 million yuan, and some orders have been shipped one after another; The preparation production base has obtained GMP certification of the European Union and cGMP certification of the United States.

Fosun Pharma said that liraglutide (intended for diabetes indications) is in the phase III clinical trial stage in China; Smegliptide injection and deglutinin injection (intended for diabetes indications) are in the phase I clinical trial stage in China.

The research and development intensity of diet pills concept stocks is much higher than that of A shares.

The research and development of innovative drugs requires long-term and high-risk investment. Pharmaceutical companies need strong scientific research strength and financial support to develop an innovative drug in numerous researches. High-intensity research and development is essential to deus ex in the crowded diet drug track.

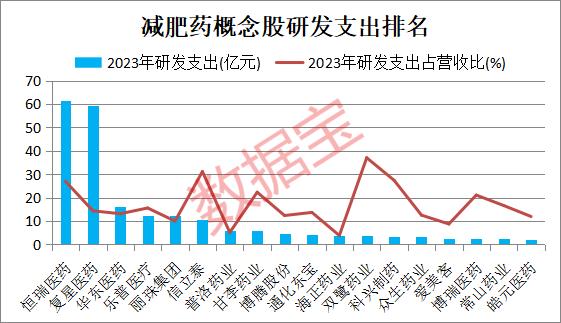

According to the statistics of Securities Times and DataBao, the total R&D expenditure of diet pills concept stocks in 2023 was 23.858 billion yuan, accounting for 10.26% of the total operating income, and the R&D expenditure accounted for 4.09 times of the A-share level in the same period.

Hengrui Pharma, Fosun Pharma, Huadong Medicine, Lepu Medical, Livzon Group and Xinlitai have 6 concept stocks whose R&D expenditure in 2023 exceeds 1 billion yuan. Among them, Hengrui Pharma’s R&D expenditure in 2023 was 6.15 billion yuan, ranking first; In 2023, the company obtained 72 clinical approvals for innovative drugs and 4 clinical approvals for generic drugs; Five clinical trials were included in the list of breakthrough treatments.

The future prospects of many diet pills concept stocks are optimistic by the organization. According to the statistics of data treasure, according to the unanimous prediction of more than five institutions, there are 11 concept stocks whose net profit growth rate will exceed 20% in 2024 and 2025. As of the close of May 22, among these concept stocks, the rolling P/E ratios of Prius, Sunshine Nuohe and Orrit are less than 30 times. (Data Bao Liang Qiangang)