Large-scale limit! Soda Association being investigated? Official solemn statement!

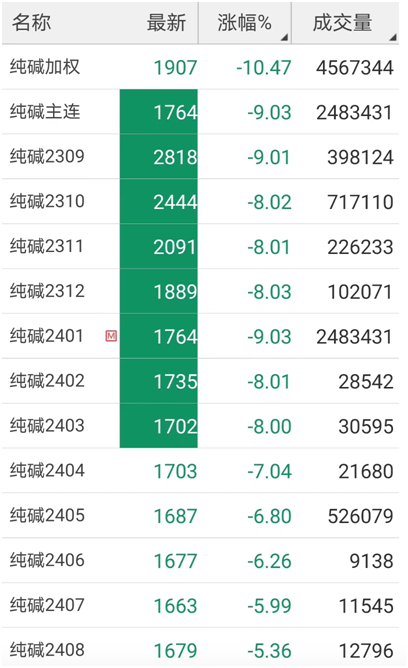

Ups, market reversal? After about two weeks of rising, soda ash futures showed a large-scale down limit on August 29.

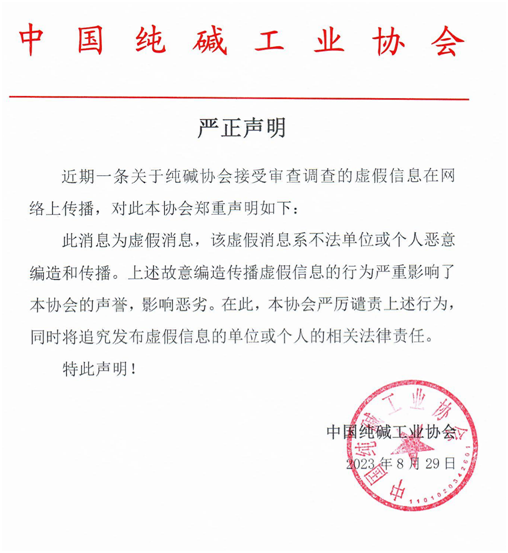

China Soda Industry Association issued a statement on August 29, saying that a recent false information about Soda Industry Association’s censorship and investigation was spread on the Internet. The Association solemnly declared as follows:

This news is false news, which is maliciously fabricated and spread by illegal units or individuals. The above-mentioned deliberate fabrication and dissemination of false information has seriously affected the reputation of the association and has a bad influence. In this regard, China Soda Industry Association severely condemns the above acts, and will investigate the relevant legal responsibilities of units or individuals who publish false information.

Previously, it was circulated on the Internet that China Soda Industry Association was under review and investigation. At present, some related messages and videos have been deleted.

The market is expected to be broken, and the rise of soda ash has come to an abrupt end?

Soda soda, also known as soda, alkali ash, alkali noodles or washing alkali, consists of sodium carbonate. Soda soda is an important basic chemical raw material and one of the "three acids and two alkalis". It has the reputation of "the mother of chemical industry" and is widely used in many fields of national economy such as building materials, chemical industry, metallurgy, textile, food, national defense, medicine and so on.

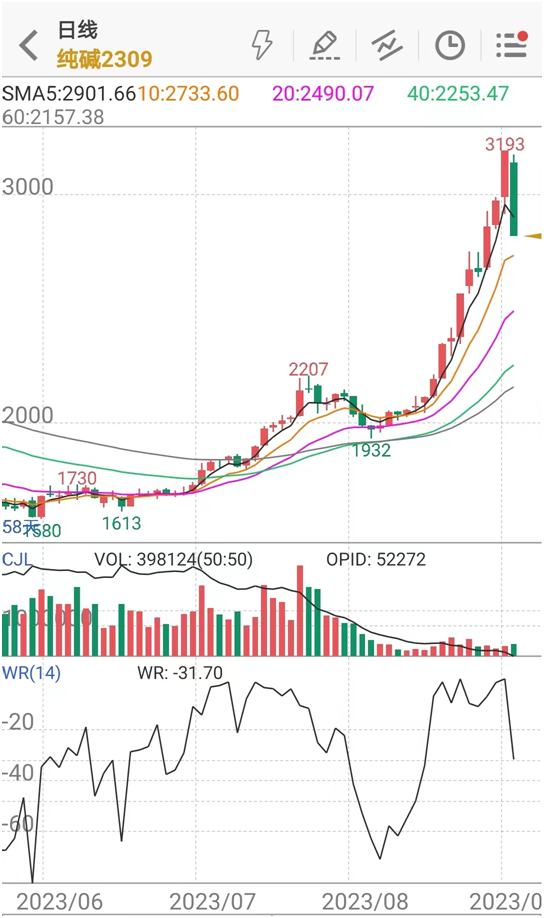

Recently, soda ash futures fluctuated greatly. Take the 2309 contract as an example. As of the close of August 28th, the contract rose by more than 7.33% to 3,193 yuan/ton, setting a new high in nearly 16 months. As of the afternoon of August 29th, the 2309 contract closed at the limit.

The failure to put in new capacity is an important reason for the rising price of soda ash. On August 28, the above expectations were broken.

Yuanxing Energy said on the investor interaction platform on August 28 that the No.2 boiler of the first phase of Alashan natural alkali project has been ignited, and the second production line is planned to be put into trial operation in the near future; The first phase of four production lines is planned to be put into operation in the year.

Yuanxing Energy said that the capacity load of the first production line of the first phase of Alashan natural alkali project is currently maintained at about 90%, and heavy alkali products account for more than 50%; No.2 boiler has been ignited, and the second production line is planned to be put into trial operation in the near future.

Previously, the market generally speculated that the capacity release progress of Alashan trona project was slow, and at the same time, the release of another set of 2 million tons of new capacity of Jinshan Chemical was not as expected, which made the impact of new capacity of soda ash on supply and demand difficult to cash.

Guangfa Futures believes that if the first production line of the first phase of Yuanxing Energy Alashan Natural Alkali Project reaches the production capacity stably, and the second production line is put into operation at the end of this month or early next month (the time has not been determined), the operating rate of the old production capacity will be restored one after another and return to the normal level in the middle and late September. It is expected that the gap between supply and demand will continue for 1-2 weeks, and the shortage pattern can not be reversed temporarily. It is expected that the phenomenon of obvious accumulation of soda ash in the short term will be difficult to occur.

At present, the inventory of soda enterprises is still at a low level. Longzhong information data shows that the inventory of soda enterprises last week was 146,000 tons, down 11.35% from the previous week. Among them, the inventory of light alkali was 96,000 tons, a decrease of 13.90% from the previous week, and the inventory of heavy alkali was 50,000 tons, a decrease of 6.02% from the previous week. Last week, the social link of soda ash was 20,000 tons, the inventory days of downstream glass enterprises fell below 9 days, and the inventory of soda ash industry chain remained low.

The exchange has repeatedly "cooled down"

In view of the recent sharp fluctuation of soda ash futures, Zhengzhou Commodity Exchange has also taken many measures recently to "cool down" the market.

On August 22, Zhengshang Institute issued a risk warning letter for soda ash futures, saying that there are many uncertain factors affecting soda ash market in the near future and the price fluctuates greatly. Please strengthen investor education and risk prevention to remind investors to participate rationally and trade in compliance.

On August 24th, Zhengshang Institute announced that it would impose trading limits on some contracts of soda ash futures from midnight on August 25th. Among them, in 2023, the single-day opening limit of four contracts in recent months was 1,000 lots, and in 2024, the single-day opening limit of eight contracts in distant months was 10,000 lots.

On August 25th, Hengshui Cotton and Hemp Corporation and Hubei Jiaotou International Multimodal Transport Port Co., Ltd. were added as designated soda delivery warehouses.

On August 28th, Zhengshang Institute informed that the minimum open position of soda ash futures contracts 2309 and 2310 should be adjusted to 4 lots, while the trading margin standard of soda ash futures contracts 2310, 2311 and 2312 should be adjusted to 12%, and the price limit of soda ash futures contracts 2309, 2310, 2311, 2312 and 2401 should be adjusted to 10%.

Everbright Futures said that the sharp weakening of the futures market was mainly affected by the exchange’s risk control measures such as adjusting some contract margin standards, the range of price limit, the minimum opening order of trading orders and trading limits. However, the spot market is still strong, the downstream demand purchasing sentiment is still high, and the low inventory state of the whole industry chain continues to be maintained. On the whole, the phenomenon of tight spot of soda ash still exists, and the departure of futures disk funds drives the futures price to fall rapidly. In the later stage, we should pay attention to the changes of new production capacity in the industry.

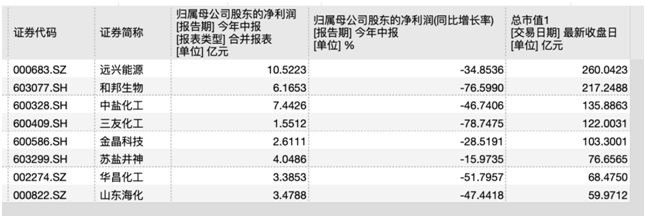

The performance of soda ash enterprises declined in the first half of the year.

In the first half of this year, the profitability of soda ash listed companies generally declined. The net profit of soda ash enterprises such as Yuanxing Energy, Shandong Haihua, Shuanghuan Technology and Sanyou Chemical decreased year-on-year.

For example, Hebang Bio achieved a net profit of 617 million yuan in the first half of this year, a year-on-year decrease of 76.6%. Hebang Bio said that due to the macro-economy and changes in market supply and demand, the market price and sales volume of some products of the company have declined to varying degrees compared with the same period of last year, and the performance has dropped significantly year-on-year. At the end of the second quarter, the market conditions of the company’s main products picked up, and product prices stabilized and rebounded.

Wu Yujiao, an analyst of Jinlianchuang Soda, said that in the second half of 2023, the soda production capacity increased by about 8 million tons, which was close to 25% of the national total production capacity, specifically, the expansion of 200,000 tons of soda plant in Anhui Hongfangfang, the 5 million tons of natural alkali project in Yuanxing Energy Phase I, the relocation of 600,000 tons of plant in Debon, Jiangsu, the upgrading of 200,000 tons of plant in Xiangyu Salt Chemical Company in Chongqing and the expansion of 2 million tons of plant in Jinshan Chemical Company in Henan. If the production capacity of the above-mentioned manufacturers is put on time, the production capacity of soda ash will reach a new high in 2023, and the original supply and demand pattern of the market will be broken.

"The centralized launch of new production capacity will have a great impact on the market supply side in the short term, which is manifested in the obvious increase in market supply and the decline in market prices." Wu Yujiao said that alkali enterprises have gradually changed their sales models, increased market development and broadened sales channels. The downstream demand side may reduce the standing stock, use soda ash as it is collected, and adjust the procurement plan in a timely manner. In addition, alkali companies and downstream enterprises will also strengthen the use of futures tools to better manage operational risks.

In terms of downstream demand, Wu Yujiao believes that float glass production will maintain a certain strength, the cost and profit of glass enterprises will tend to improve, and the demand for soda ash will remain strong. In terms of photovoltaic glass, considering that the capacity of photovoltaic glass under construction exceeds 50,000 tons/day, the output of photovoltaic glass is expected to maintain a high growth rate in the short and medium term, and the demand for soda ash is increasing significantly. But in the long run, with the photovoltaic glass industry entering surplus, the new supply of photovoltaic glass industry will gradually decrease, and the demand for soda ash will decrease.

Proofreading: Tao Qian